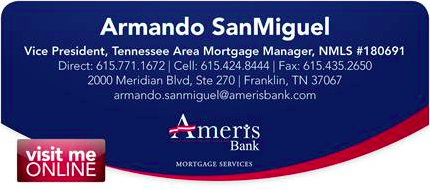

Armando SanMiguel Ameris Bank

Armando SanMiguel has been at the forefront of the mortgage industry for over 13 years now and has quickly risen to be one of the most highly respected and admired loan officers in the mortgage business.

Since joining Ameris Bank, he has become the Senior Vice President and the Director of operations for Tennessee. He has developed a strong team of loan officers and support staff to help develop his realtors business and provide excellent service to his clients.

To work directly with Armando just click HERE.

Contact Armando directly at 615 424 8444