What to Know About Interest Rates and Home Buying

Posted by Gary Ashton on Tuesday, October 23rd, 2018 at 11:12am.

You may be looking to buy a new home, and, depending on the local market, there may be a variety of available properties suitable for individuals, couples and families. While many potential homebuyers need a mortgage to cover the cost of buying a home, most are initially unaware of the role of interest rates when making a purchase and affording mortgage loan payments. Rising interest rates may mean that homebuyers who have to tighten their purse strings to afford a dream home will struggle to make regular payments. What should potential homebuyers and mortgage loan borrowers know about interest rates?

You may be looking to buy a new home, and, depending on the local market, there may be a variety of available properties suitable for individuals, couples and families. While many potential homebuyers need a mortgage to cover the cost of buying a home, most are initially unaware of the role of interest rates when making a purchase and affording mortgage loan payments. Rising interest rates may mean that homebuyers who have to tighten their purse strings to afford a dream home will struggle to make regular payments. What should potential homebuyers and mortgage loan borrowers know about interest rates?

Is it better to buy a more expensive home with low interest rates or a more affordable home with higher interest rates? What are tax limitations that may not account for rising interest rates on a home mortgage? Understand more about interest rates when looking to buy a home and make realistic mortgage payments today.

For informational purposes only. Always consult with a licensed mortgage professional before proceeding with any real estate transaction.

Rising Interest Rates

While some may have been able to secure a mortgage loan with relatively low interest rates, there will be times when potential homebuyers may seek a loan even though interest rates are on the rise. There are some issues with rising interest rates. Those approved for a home mortgage loan may be paying more on the balance of their mortgage loan. This can make it harder to cover costs needed to maintain a home. It may be necessary for borrowers to reconfigure their budget when faced with rising interest rates if they need to take out a mortgage loan on a home.

Borrowers should be honest in how much house they will be able to afford, accounting for loan payments, interest rates on the loan, potential PMI for those making a small down payment, insurance and other regular payments. First-time borrowers may be surprised at how much it costs to not only purchase but maintain a home. This is why it may be wise to leave a cushion to help absorb any surprise expenses. Think about expenses over the long-term to help manage regularly occurring expenses and avoid becoming house poor.

Interest Rates and Deductions

While interest rates may be on the rise, there are more limitation for homeowners when it comes to their taxes. Homeowners are limited to $10,000 in deductions with the current Tax Cuts and Jobs Act. This means that some homeowners will not be able to deduct as much in local, state and property taxes. For those living in areas with higher taxes, some expenses will not be able to be written off. Taking a higher standard deduction will also make it hard for individuals and couples to itemize mortgage deductions. The cap has also been lowered with a limit of $750,000. It seems likely that homeowners will be taking the higher standard deductions and will not be as prone to itemizing their expenses.

Interest Rates and Sales Prices

While some individuals may wait for home prices to fall before buying, that may not be the best strategy.Savings from decreasing home prices may be absorbed by high interest rates. This can happen in instances such as when a home price drops from $240,000 to $210,000. It may seem like the time is good to buy. However, if the interest rate has risen from 4.5 percent to 6.5 percent in the meantime, it would have been better to buy the home when the interest rate was lower. The difference in interest rate on such a home could amount to over $34,000 when making payments on an 80 percent LTV mortgage over 30 years.

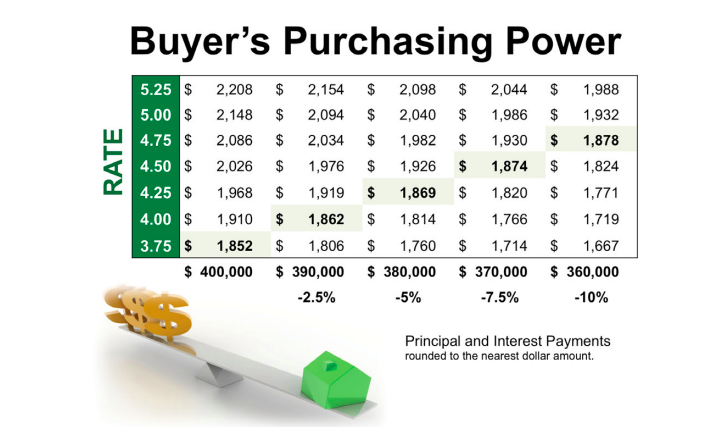

Potential buyers should be well aware of how much rising interest rates may cost them over the lifetime of a home mortgage loan. An increase in interest rates may make for less purchasing power if a potential buyer wants to keep mortgage payments in a specific range. In certain price ranges, one may lose $50,000 or $100,000 in purchasing power with only a 2 percent hike in interest rate.

How Much 1% Matters With Interest Rates

Shopping for a new home can be a tricky process. It requires a pre-approved mortgage, down payment and the right real estate agent.

Even with all the right things in place and the perfect Nashville home, you may still pay more for the home than you should. Understanding how much a 1% difference in your mortgage interest rate makes can change your decision.

Interest Rates are on the Rise

Last year the mortgage interest rates were between 3% and 4%, but they are expected to rise. By the end of this year, many predict they will climb to an average close to 5% and by 2015 that average will be 6%.

How Much does 1% Matter?

When looking at a $300,000 home, it's a significant difference in monthly payment and how much you will actually pay for your home. A 4.5% interest rate, after a 20% down payment will save you $147 on your monthly payment compared to a 5.5% interest rate. Could you use an extra $147 per month?

The 1% difference breaks down as follows:

- A savings of nearly $2,400 in the first year alone

- Over $34,000 saved over 15 years

- Nearly $53,000 savings over a 30-year term

The savings is significant for sure. Many people could use the extra $147 every month for many different things. Imagine what you could do with this savings.

Making Sure you Get the Best Deal Possible

Before you start shopping for your new home, it's a good idea to get a pre-approval for a mortgage. This gives you buying power and a price range for your new Nashville home. However, the first pre-approval you receive may not be the best deal.

Shopping your pre-approved mortgage is a good idea. Sometimes, you can tell a second mortgage company what interest rate you are getting from the first and they will beat it. Don't be afraid to negotiate for the best possible deal before you buy your new home.

Consider Interest Rates When Buying

Potential homebuyers who are stretching to pay for a Murfreesboro home they have fallen in love with may need to carefully review the rates. Those applying for loans without a fixed-rate may find it difficult to keep up with payments. Higher interest rates may mean that homeowners may have to look for homes at the lower end of their price point. Those who want to get more home for their money may want to wait until interest rates decline as they would then gain additional purchasing power. Understand the terms and conditions of a home mortgage loan before borrowing from a lender.

For informational purposes only. Always consult with a licensed mortgage professional before proceeding with any real estate transaction.

Gary Ashton

The Ashton Real Estate Group of RE/MAX Advantage

The #1 RE/MAX team in the World!